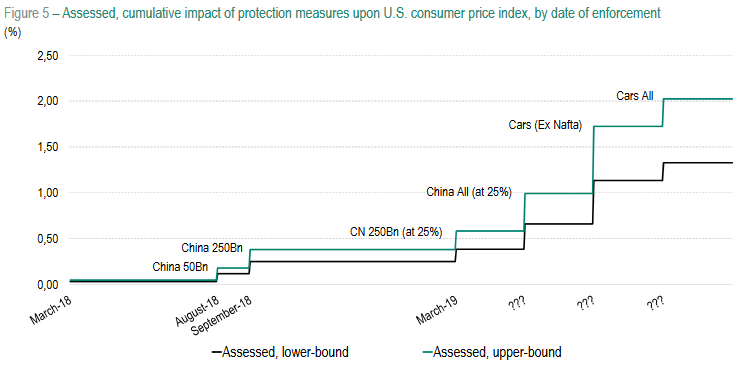

To address this question, we identify and quantify three channels: direct taxation, cost increase linked to taxes on intermediate inputs, and altered pricing strategy resulting from strategic complementarities across firms.We reckon that the additional duties enforced up to December 2018 should increase inflation in the US by 0.25% to 0.38%. Should all US imports from China be hit with a 25% tariff, the total inflationary impact would range between 0.66% and 0.99%. Levying 25% additional duties on imports of autos and auto parts would more or less double down this effect, by adding 0.67% to 1.03% to inflation if all providers are targeted, and 0.47% to 0.73% if Canada and Mexico are excluded. Sébastien Jean & Gianluca Santoni >>> |

- How Far Will Trump Protectionism Push Up Inflation?

Sébastien Jean, Gianluca Santoni

- Uncertainty Shocks and Firm Creation: Search and Monitoring in the Credit Market

Thomas Brand, Marlène Isoré, Fabien Tripier - Sovereign Risk and Asset Market Dynamics in the Euro Area

Erica Perego - On the competitiveness effects of quality labels: Evidence from the French cheese industry

Sabine Duvaleix-Treguer, Charlotte Emlinger, Carl Gaigné, Karine Latouche - Techies, Trade, and Skill-Biased Productivity

James Harrigan, Ariell Reshef, Farid Toubal - Firms' Exports, Volatility and Skills: Evidence from France

Maria Bas, Pamela Bombarda, Sébastien Jean, Gianluca Orefice

Theories and Methods in Macroeconomics (T2M) - 23rd Conference

March 22 - 23, 2019

19th Doctoral Meetings in International Trade and International Finance

June 27 - 28, 2019

|

- Contact us

- Our other sites

|

ISSN: 1255-7072

Editorial Director : Antoine BouëtManaging Editor : Dominique Pianelli